The Lifetime Allowance was introduced in 2006 as part of pension simplification and like all things regulating pension benefits it has developed into something that is far from simple and is increasing impacting more individuals.

The original limit is April 2006 was £1,500,000 and this increased incrementally until it reached £1,800,000 in 2011. However, from 2012 it gradually decreased, reducing to £1,000,000 in 2017 and it increased in line with inflation in subsequent tax years, the government last year announced that the limit will be frozen at £1,073,100 until April 2026.

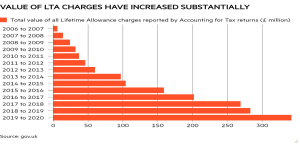

The impact of these changes to the allowance has significantly increased the amount generated in Lifetime Allowance tax charges in recent years and the tax charges will continue to increase over the next five years as more individuals will be impacted by the frozen Lifetime Allowance.

Identifying those who could be potentially impacted by the Lifetime Limit

1. Public Sector employees with long service and salaries over £80,000 per annum.

2. Individuals with Money Purchase Pension Funds over £500,000

3. Individuals with a combination of Final Salary Benefits and Money Purchase Pensions.

4. Individuals who defer assessing their pension benefits

Looking at the fourth category, we are increasing dealing with individuals who have reached are approaching age 75 and have uncrystallised pension savings.

The age of 75 is a milestone for pension savers and brings a range of implications for your money.

None of these implications can be avoided completely, but they can be prepared for and mitigated with proper planning.

It is a good idea to identify as early as possible before the age of 75, those who could be impacted by the Lifetime Allowance Test at age 75 to ensure you’re not caught off-guard.

Four potential planning actions to take before age 75 to minimise any potential tax charge are:

1. Selecting the right scheme

Some old pension plans do not offer the full range of benefit options available under current legislation and it is therefore important you are in a pension scheme which meets your specific objectives and gives you the desired amount of flexibility in how you access your money at any time. It is important to review existing plans well before age 75 as some plans will not allow transfer post age 75 and individuals may be required to buy an annuity or take a scheme pension with any funds in excess of their Pension Commencement Lump Sum.

Having this conversation at the earliest point not only gives you the maximum amount of time to consider your options – it also helps reduce the risk of facing inadvertent inheritance tax (IHT) issues.

If a scheme member dies within two years of a transfer, a value may be placed on the transfer itself, which could result in IHT becoming due.

2. The lifetime allowance test at age 75

At 75, uncrystallised funds along with funds that have been crystallised but left in a drawdown account will be assessed to determine whether they exceed the lifetime allowance (LTA).

If the total value to be assessed is over the LTA, thought should be given to the order in which each scheme is tested.

While the cost for breaching the LTA will be a 25% tax bill on any excess in any situation, the ordering of testing can make a real difference. Fortunately, you can choose the order which schemes are tested at age 75 as long as all scheme providers are kept informed.

Primarily it will determine which schemes will actually have to pay the charge.

Those assessed first, if within the LTA, will not have to share any of the tax burden.

3. Death benefit nominations

Reviewing death benefit nominations is a crucial factor when managing a potential tax liability, particularly where benefits have been nominated to a trust. Before age 75, death benefits are generally free from income tax on the member’s death. However, they are subject to income tax if the holder dies after their 75th birthday.

Where a lump sum is paid to a trust on death after age 75 the pension provider must deduct tax at 45%, and consequently, this leaves only 55% of the remaining funds available for investment by the trustees.

Alternatively, if the beneficiary/ies inherit the pension pot, the full amount remains invested and they will only pay income tax as and when they draw money from it, thereby controlling when income tax become payable.

Trusts provide greater control who benefits from the death benefits and when, however those with benefits nominated to a trust rather than individual beneficiaries need to consider whether their priority is control over benefits or tax planning.

4. Tax-free cash – stick or twist?

When it comes to tax-free sums, you need to carefully consider which path is likely to result in the lowest tax charge given your specific circumstances. Not every scheme allows individuals to delay taking tax-free cash beyond the age of seventy-five.

If you can access their tax-free sum after 75 and dies after your 75th birthday but before taking their tax-free cash, the remaining funds would all be subject to income tax at the beneficiary’s marginal rate. The original member can only take the tax-free cash.

That’s not to say that tax-free cash should always be taken either before or after age 75. Taking tax-free cash from the pension will potentially expose it to 40% IHT in the estate unless it is actually ‘spent’ or gifted and outside the estate when the member dies.

If you do not not need the benefits, they could be left in the pension and inherited by beneficiaries on death, who may be able to access the funds as and when they want potentially at lower rates of tax.

Summary

Like the changes to the Annual Allowance in recent years, an increasing number of individuals are facing unexpected tax bills in recent of their pension funds. It is important that individuals are aware of the potential impact of the Lifetime Allowance on their pension funds as earliest as possible to help ensure that they are in the strongest possible financial position. Putting off reviewing pension funds could limit choices and have potentially significant tax implications for you and your beneficiaries.

The other point to make is that a Lifetime Allowance liability is not the end of the world – you’ll still have more valuable pensions than those below the threshold. In any case, there is no tax to pay until you begin crystallising your pension fund savings, and phasing that process can defer the liability.

If you feel you may potentially be impacted by the Lifetime Allowance and would like to have an initial discussion, please do not hesitate to contact us.